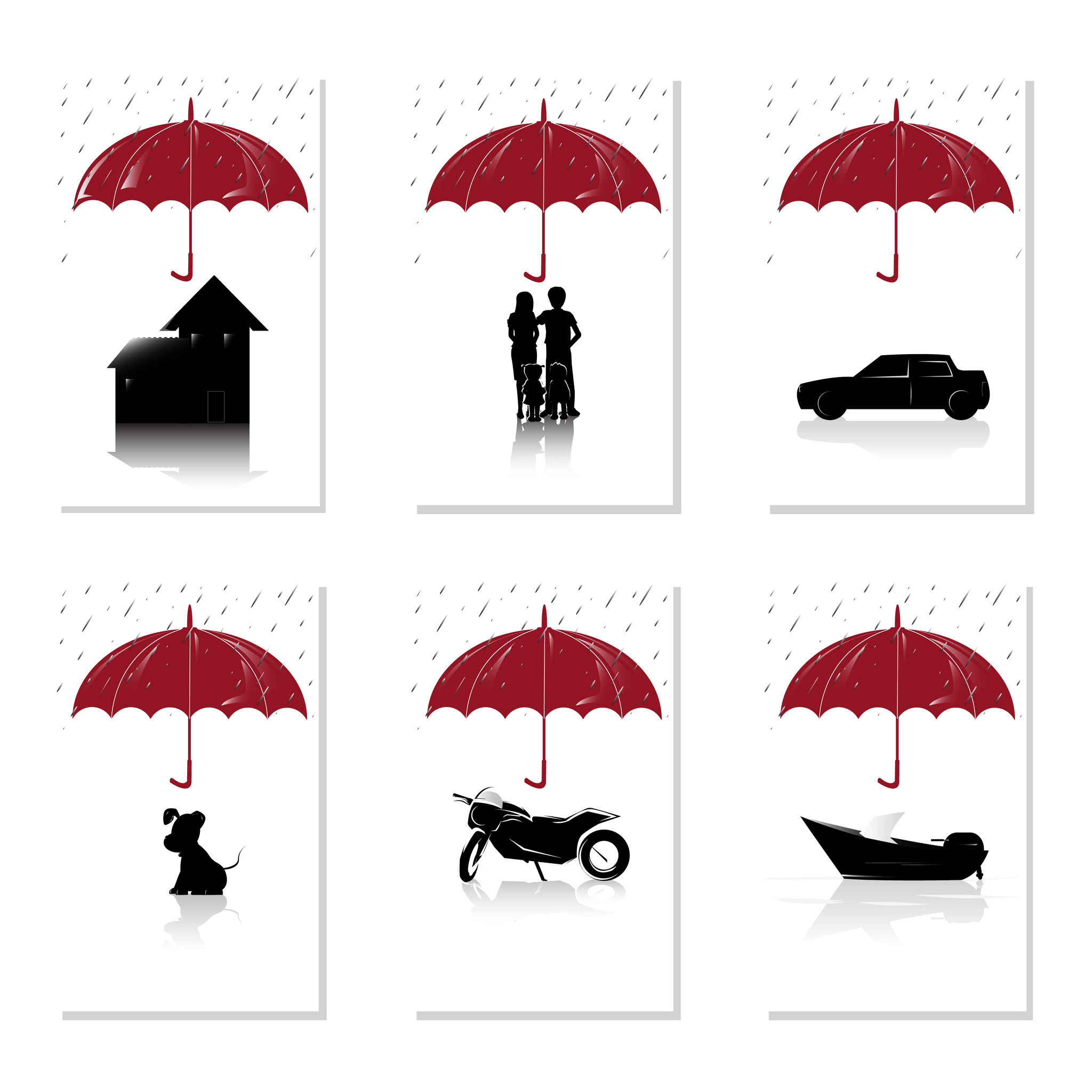

Insurance is an unavoidable cost of living and feeling protected. There should be no reason why a family is paying a lot more for their insurance than is necessary if they apply the two below strategies to their policy. The first is a package deal. Push auto and home together into one nice payment. The second is about expectations. Be careful of under-insuring and paying the price.

Package Home and Auto

Insurance Products come in so many forms, and juggling all these different insurances is an unquestionable hassle. Make matters easier by grouping the two most common Insurance Products, auto and home, into one payment. Many substantial insurance companies offer both, so packing them is no issue at all. Since the customer is adding more to their service, they get relevant savings.

Get a Home Replacement Assessment

Home-owner’s insurance has a complete replacement payout. This is the amount the insurance company will disburse in case of a fire within the home and a recorded complete collapse of the property. Home-owners make the mistake of under insuring to save money. The strategy works to save money, but life changes may force someone to reassess how under insured they want to be. A way to test this is to get a home replacement assessment. Call the insurance company and arrange a fictitious ‘what if’ event. A reputable company will be more than happy to indulge in this idea to make sure their client has insurance they are comfortable with. The amount one is looking for is a full home damage payout. Is that number acceptable? Life changes may include a built on room extension or a slew of new items purchased and collected over the years. Perhaps a marriage brought in a lot of new furniture and expensive items.

There is an addition known as extended overage. It is a cost added to the insurance that adds a 30% payout on top of the current assessment. This is a, fortunately, intelligent way to pad against a potential lower than expected home replacement number. In all, insurance products do not need to be pricey or mysterious.