Everyday we open our eyes we face some type of unexpected danger. These problems may occur from a variety of health concerns, inopportune accidents, inadvertent effects caused by the actions of other people or simple neglect by ourselves or some other party. Because these situations are unexpected there are few ways to prepare ourselves for the consequences they may cause. For example, a simple electrical short in our home could lead to a serious fire resulting in property damage, bodily harm or even death. Plus, many of these catastrophes leave us open for financial ruin because of liability issues we may never even have considered.

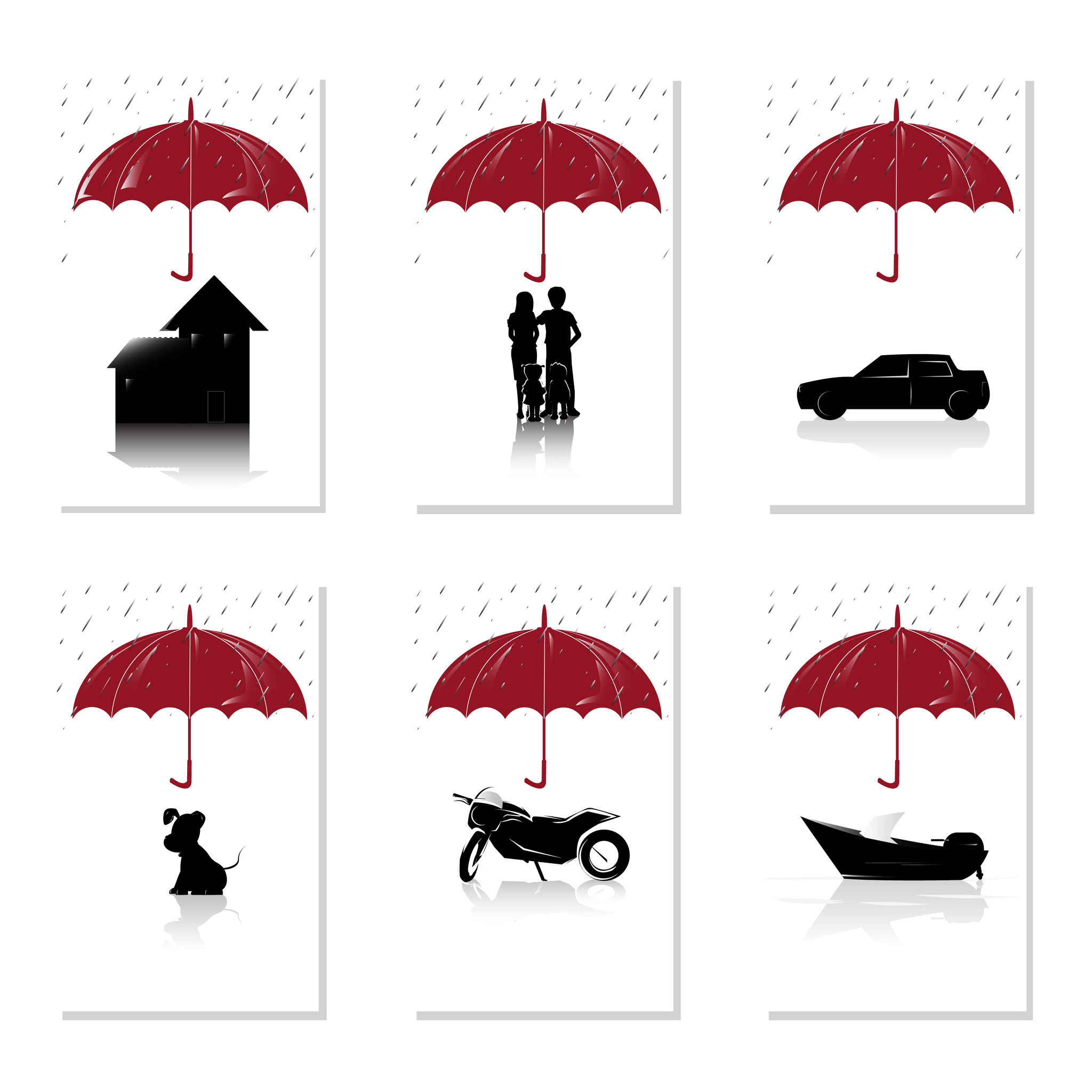

To protect ourselves, our family and our property we must really consider every means necessary. This includes due diligence for ensuring our property is clean and well repaired along with the financial protection we get from insurance policies provided by Insurance Baltimore MD. Insurance coverage fulfills many different needs and every person or family has different requirements. Perhaps the most commonly used policies include health care and homeowners coverage as well as your standard automobile insurance for liability and damages.

These basic policies are important for general coverage, but other insurance policies are beneficial for protecting our financial security. One of the more important homeowner coverage requirements include liability for damages to persons or property who are affected by happenstance at our home or any property we own. This coverage can protect the policy holder from serious claims due to accidental harm on or by their property. Just as important for those who don’t own land or a home are the newer renter policies that protect the holder from unexpected property loss.

Insurance Baltimore MD policies come in a variety of coverage types to suit every need. These are typically defined by cost and coverage. Generally the more coverage you require the higher the cost, but in many cases insurance companies like Atlantic Smith Cropper & Deeley can get better policy terms when your requirements are higher. For example, if you need a combination of homeowner, auto or other policies the broker can usually find a great deal that will save you a lot of cash.